Philip Hammond’s recently stated target to build 300,000 new homes a year in the UK is seen by many as fanciful. As demand continues to outstrip supply, building more homes is part of the solution for the housing crisis that has seen the average price paid for property in Mid Somerset rise from £206,536 to £247,511 in the last 10 years.

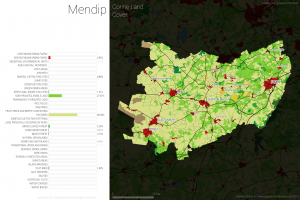

Many people ask where we will build all these homes? Well it may surprise you that only 4% of land in Mid Somerset is built on – 3.95% to be precise. For the UK as a whole just 6% of land is built on.

88% of Mid Somerset land is farmland (fields, orchards etc.), 6% is natural (moors heathland , natural grassland etc) and 2% is green urban (parks, gardens, golf course, sports pitches etc.).

The four categories are drawn from 44 different land use codes used by the Co-ordination of Information on the Environment (Corine) project initiated by the European Commission in 1985.

{click on image above to make it larger}

Mid Somerset is greener than you think! The idea that a large part of Mid Somerset has been concreted over is simply not true. Undoubtedly the effect of building has a effect on the environment beyond the footprint of the building from the visual impact to the roads needed for access and with this the pollution (noise, light and air).

I am not suggesting we concrete over every inch of our beautiful county, but the bottom line is we, as a country, are growing at a quicker rate than the households we are building. We need to build more homes in Mid Somerset and we all need accept this and local authorities need to do what they can to make this happen. There will need to be compromises made otherwise house prices and rents will continue to rise exponentially in the future and the next generation here in Mid Somerset won’t be able to buy or rent a home.

Building more homes in villages that the younger generation can afford is something that should be considered. Currently, few people can afford property in the villages. Encouraging first-time buyers and young families into the villages will rejuvenate those things that were once part of village life but have gone into decline in recent years – pubs, post offices, shops, schools, community centres and transport services. Bringing the younger generation into the villages will have a positive impact on village life and the community spirit we all aspire to.

About Tom Morgan

Founder of Jungle Property the multi award-winning letting agent based in Glastonbury, Somerset. I am passionate about property and Glastonbury and about providing the very best advice to anyone who wants the best return on a buy-to-let property investment. For an open and brutally honest opinion on anything in the Glastonbury property market please contact me via tom.morgan@jungleproperty.co.uk

- Web |

- More Posts(119)